Concise guide to laying at betting exchanges – what is actually a “Lay Bet”, what does mean lay betting at betting exchange?

Traditional bookmakers offer you a possibility to bet on a certain event to happen – a team to win or to progress to next stage, a correct score or number of corners in the match, a scorer of first goal, and so on… Once you place a bet on those events, it’s called back bet – you have backed those events to happen.

As opposed to back bet, when laying, you bet on a certain event not to happen. If you lay a player to score a goal in football match, you will want the player not to score, in order to win your bet.

Obviously, when you place a back bet with bookmaker, bookmaker actually lays that selection – you win if your selection wins, bookmaker wins if your selection does not win.

Advantages of Lay Betting

A punter often has no solid opinion about who has good chances to win the match, or score the goal, or get a red card. But more often than not, a punter has pretty good idea about who has poor chances to win the match. Laying allows you to profit on such an opinion!

Bookmakers offer some alternatives to lay bets; for example, double chance or draw no bet. But at what odds? Compare those odds at bookmaker and actual odds you get by laying, and you’ll see a tremendous difference, sometimes as much as 50%!

Bigger chances to win. If you bet on correct scores, bookmakers offer you some dozen or two of correct scores to bet on; only one of them can be a winner at the end of the day. When laying correct scores, all but one are winners for you! Of course, that comes at much lower odds, i.e., higher risk, but for a patient punter, that can be a gold mine!

Possibility to trade your odds once they change, so to lock in a guaranteed profit, nevermind of final outcome.

What is my potential risk and winnings in lay betting?

Let’s compare it with “traditional” betting. Say, we have match Manchester United vs. Sunderland. Man Utd is offered at odds 1.50, Sunderland at odds of 6.50, while draw is priced 4.50.

If you bet on Man Utd to win, with 10 units stake, your potential profit is 5 units (in case Man Utd wins the match), and your potential loss is your stake, 10 units (in case Man Utd fails to win). Similarly, if you put the same amount of money on other two outcomes, your potential profit is 35 units (if you bet on draw), or 55 units (if you bet on Sunderland), while you potentailly risk to lose your stake, the same amount of 10 units each time.

Now, if you lay the above bets, your risk and profit will be exactly the opposite amounts from the above example; just imagine you’re a bookie who accepted the bets above!

So, let’s say, you lay Man Utd, at odds of 1.50, again with stake of 10 units; in this case, the stake is sometimes called “lay stake” or “backer’s stake” – that’s amount of money risked by punter who accepted the opposite bet, back Man Utd. That means, if Man Utd fails to win the match (it’s draw or Sunderland wins), backer loses his stake of 10 units, and that’s the amount you win, it’s your profit in case your lay bet is successfull. In fact, it’s your gross profit; namely, betting exchanges earn money by taking commission from your profit; Betfair takes commission of 5% (which gradually decreases as you place more bets, but not as fast as you’d like…), while Smarkets take only 2%; so, amount of money you would actually pocket – your net profit – from this bet would be 9.50 units on Betfair, or 9.80 units on Smarkets.

However, if Man Utd accomplishes its mission and wins the match, then backer stands to win his 5 units profit… and you are the one who needs to supply it – you lose those 5 units! You don’t pay commission on losses, so your total loss in this case amounts to 5 units; backer is the one who will pay commission on that amount of money he won.

Your loss in this case, i.e., amount of money you risk, is called liability, and obviously, it’s calculated as:

Liability = (Decimal Odds – 1) * Lay Stake

Let’s apply this logic to the other two selections.

If you lay the draw with stake of 10 units, you will win 10 units (before commission, don’t forget!) if matchs does not end in draw, and you will lose 35 units if match ends as draw. If you lay Sunderland with the same stake, you will again win 10 units before commission if Sunderland does not win, and you will lose 55 units if Sunderland does win.

Obviously, higher the odds you lay at, higher your liability. Thus, you may want to limit your liability, and lay at fixed liability, while stake (i.e., potential profit) varies, depending on odds.

Using above formula, you can easily determine lay stake needed for certain liability:

Lay Stake = Liability / (Decimal Odds – 1)

Thus, if you would like to risk 10 units in each of abore examples, you would stake 20 units on Man Utd, 2.86 units on draw, and 1.82 units on Sunderland; that would be your profit in case your lay bet is successfull.

Pay attention that above odds are taken just for example – in reality, lay odds are always slightly higher than back odds at the moment. Of course, they dramatically change over the time, before kick-off, and especially during the match, which allows punter to trade – read more about trading in next pargraph.

In “traditional” betting, higher the odds you take, the bigger is ratio between your potential profit and loss. However, in lay betting, it’s quite the opposite – higher the odds you lay at, lower your potential profit, in comparison with liability.

Is there any alternatives to lay betting?

Yes, there are; traditional bookmakers offer some markets that works as exact alternatives to lay betting. When it comes to betting to match winner, 1X2, market, alternatives to laying are double chance and asian handicaps. For example, in match Man Utd vs. Sunderland, lay bet on Man Utd is exactly the same as double chance bet on Sunderland or asian handicap Sunderland +1.

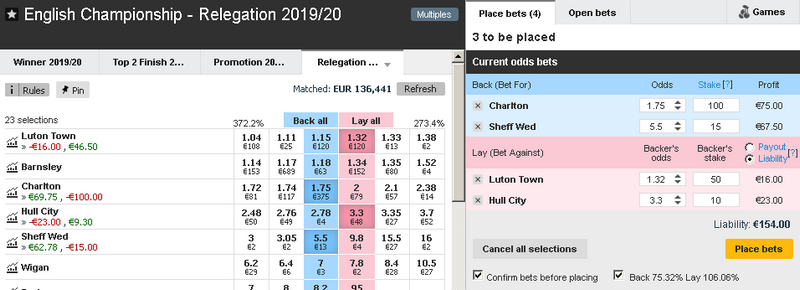

However, these alternatives come at very expensive price: odds, and therefore potential profit, are much lower. Let’s check the example; exchanges offer Bournemouth to lay against Leyton at odds of 1.89; that means, for liability of 10 units, you get gross profit of 11.23 units, or 10.67 units after commission; with lower level of commission, you get higher profit; Smarkets offer standard commission of 2%, but its odds are usually a couple of ticks higher than on Betfair. However, on Bet365, one of the most known bookmakers, you can bet on double chance, Draw or Leyton, at odds of 1.83; that means, risking 10 units, you’ll get profit of only 8.30 units, or about one fourth less than at exchanges!

In addition, traditional bookies are known to limit successfull punters, while on exchanges, you’re limited only by liquidity of the market – amount of money offered on that market by other punters. Thus, if you can use betting exchange (it’s allowed in your country & you have sutiable payment gateway), you should immediatelly go for it!

What is Trading?

You know very well that odds change, before kick-off of the match, as well as during the match, if it’s offered for in-play, live betting.

If you’re lucky or knowledgable enough to place your bets in right moments, you can acquire a guaranteed profit, nevermind of final outcome: if you placed back bet at higher odds than lay bet, you’re guaranteed to make a profit; it’s so-called “greening up”. Otherwise, if your lay odds are higher than back odds, you cannot make a guaranteed profit, or, depending on your stakes, you incur loss on each selection, nevermind of final outcome – accordingly, it’s called “redding up”. You may adjust stakes so to have equal profit on all selections (that’s called “Hedging”), or different profit on various selections. In any case, order of bets does not play a role, it’s the same whether you placed your back or lay bet first; it’s only odds and stakes that affect your profit.

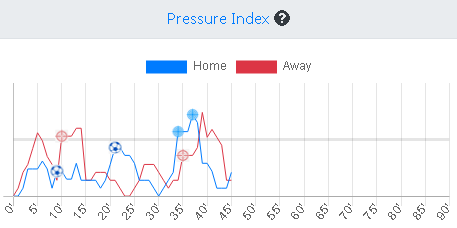

Generally, odds on a favourite in a football match start to increase as soon as match kicks off, while odds on draw shorten after kick-off; odds on outsider slightly shorten or remain the same during most of the first half, and more often than not, even by the middle of the second half, assuming there has been no goal, or other significant event (red card, injury, etc.). After such an event, odds take a sudden drop or rise, and its amplitude depends on market, time of goal scored, etc.

Thus, if you lay favourite before kick-off, but you’re not comfortable to let it run by the end of the game, you may back that very same favourite soon into the match, and secure a guaranteed profit (although dramatically lower), nevermind of final outcome.

Generally, formula you can use to connect your lay and back bets is:

Lay Stake * Lay Odds = Back Stake * Back Odds

In above example, we layed Man Utd at odds of 1.50, with stake of 10 units. If there is no goal in about 10 to 15 minutes of the match, you can expect odds to drift to 1.60; if you want to run away from that match, you will back Man Utd with stake of

Back Stake = 10 * 1.50 / 1.60 = 9.38 units,

which will ensure you profit of 0.62 units, nevermind of final outcome of the match.

In similar way, you can use trading to cut your losses – if things go against you (in our example, if Man Utd scores a goal, and you feel Sunderland will not be able to equalize), you can back at lower odds than you layed at, and it will decrease your liability, i.e., amount of money you’re set to lose if Man Utd wins. However, if Sunderland manages somehow to equalize and remain unbeaten, you’re still bound to lose some amount of money (thus the term “redding up” – you lose on all outcomes!).